The UK public has a limited understanding of the basics of economic statistics like GDP, unemployment and the deficit, according to recent reports. The Economics Observatory aims to bring economics to the public in an accessible way and respond to doubts around data.

Newsletter from 27 November 2020

The UK public has a limited understanding of the basics of economic statistics like GDP, unemployment and the government’s deficit, according to a worrying report from the Economic Statistics Centre for Excellence (ESCoE) published this week. ‘Many feel economics is confusing and complicated, and regret they are unable to understand it’, co-author Johnny Runge explains. What’s more, ‘people are often sceptical and cynical about any data they see’, findings that echo what came out of a survey last year by ING and the Economics Network.

At the Economics Observatory, we aim to bring economics to the public in an accessible way and respond to some of the doubts around data. Similarly, the annual Festival of Economics in Bristol is a longstanding effort to engage with the public on economic issues central to their lives. This year’s festival was co-programmed by Diane Coyle, who founded the event eight years ago and is one of the lead editors of the Observatory, and our director Richard Davies, the country’s first professor of the public understanding of economics.

Our gathering last week was unfortunately confined to Zoom, but it did mean that we were able to bring together speakers and audiences from around the world. Some of the highlights have been summarised on the Observatory in recent days, including two sessions on sectoral and geographical prospects for recovery.

The first asked how the arts can recover, concluding that this vital sector needs further state support and a clear, realistic road map for how audiences can return safely, equitably and profitably.

The second discussed the pandemic as an opportunity to return to something better than ‘normal’ by ‘building back better’ – in this case for the city-region of Bristol and the West of England. Panellists agreed that the recovery process could give local policy-makers the chance to shape the revival.

The economics festival also featured John Kay and former Bank of England governor Mervyn King on ‘radical uncertainty’; Dieter Helm on the future of farming and the food supply chain (summarised by Richard here); and a panel on state intervention to protect public health combined with large-scale fiscal support for the economy during the pandemic – and whether these measures mean that Big Government is back.

How broke is Britain?

The Big Government conversation provided useful background for this week’s main event in economic policy-making – the spending review announced by Chancellor of the Exchequer Rishi Sunak on Wednesday – and a key question surrounding it: when and how do we pay for the Covid-19 crisis?

At a time when the health and economic effects of the pandemic have required a rise in government borrowing to levels not previously seen outside wartime, one particularly dangerous misperception is the widespread view that public finances are just like household finances – and that the UK has somehow ‘maxed out its credit card’. ‘People generally understand economic issues through the lens of their familiar personal economy rather than the abstract national economy’, as the ESCoE report notes – something that Roger Farmer calls the ‘household fallacy’.

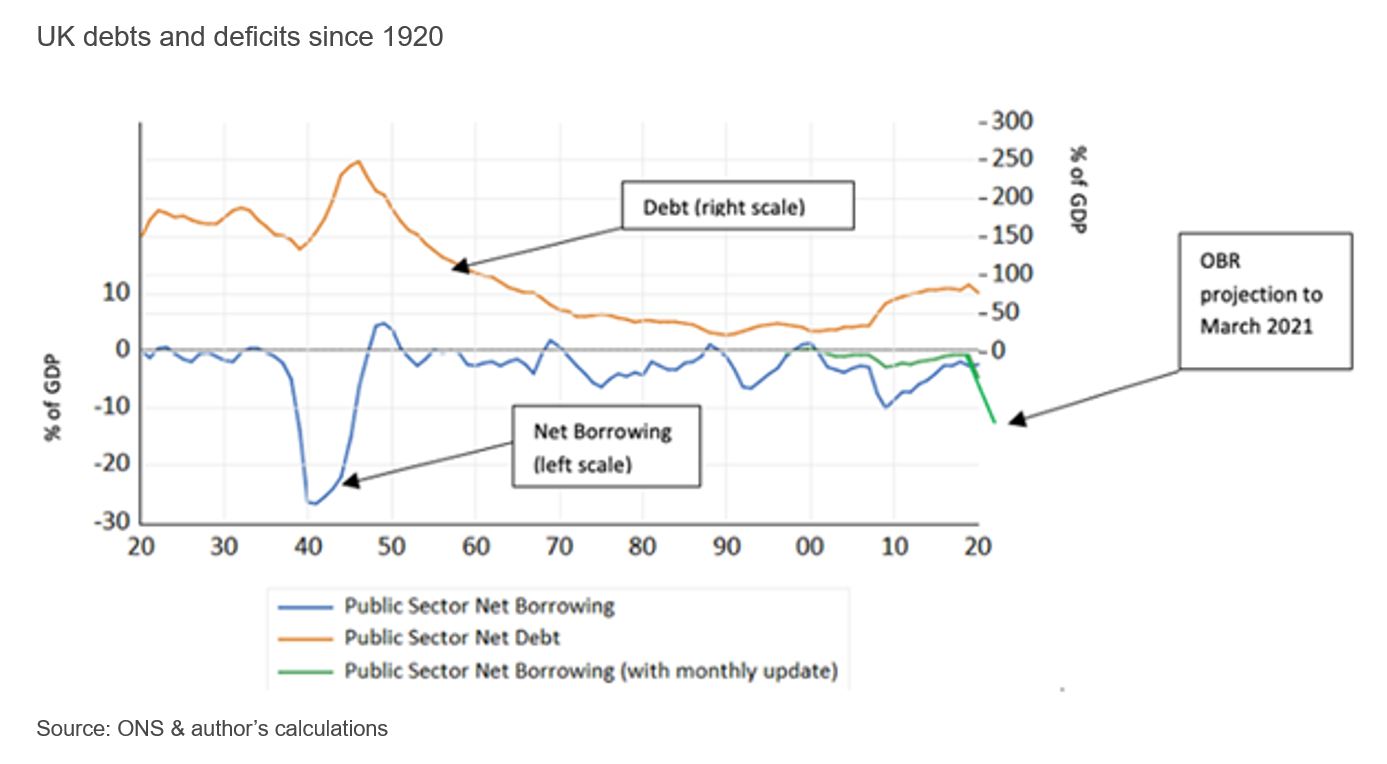

Roger’s must-read contribution to the Observatory this week outlines the dangers of the government seeking to reverse the spike in public borrowing quickly by raising taxes too soon and/or by cutting back on spending, including public sector pay. Taking a long view – he looks at UK public debt and deficits since 1920 – we have had much higher public debt-to-GDP ratios in the past and they have been reduced by post-crisis economic growth. Trying to pay off accumulated debt in the near future is likely to delay recovery.

A number of previous pieces on the Observatory have explored the lessons from history on paying for this crisis, dealing with the aftermath and promoting growth – including Roger’s Warwick Economics colleague Mark Harrison on running a wartime economy; LSE economic historian Jason Lennard on paying off public debt through the ages; and Nicholas Crafts, founder of the Centre for Competitive Advantage in the Global Economy (CAGE), on rebuilding after the Second World War.

Nick made an appearance on BBC Radio 4’s The Briefing Room programme this week, which also focused on debt and recovery, asking How Broke is Britain? In what felt a little like some of our most prominent economists offering a quick first response to the clear demand for improved public understanding, he was joined by Oxford’s Abi Adams-Prassl, who has been documenting the impact of the pandemic on workers; Gemma Tetlow, chief economist at the Institute for Government; and Jagjit Chadha, director of the National Institute of Economic and Social Research (NIESR) and one of our lead editors.

The general message was to worry less about public debt in the short term (especially with interest rates currently so low) and focus more on efforts to promote renewed economic growth, including tax reform and investment in training, public infrastructure and the care economy.

Rashford rebooted

The Observatory was set up back in June to be responsive to questions from policy-makers and the public about the crisis on which economic analysis and evidence can shed light. An early question we were asked was what difference the campaign by footballer Marcus Rashford to provide food vouchers to children from low-income families over the summer holidays might make to their lives.

Claire Crawford, Ellen Greaves and Birgitta Rabe gave some answers then – and with the government scheme now extended as the Covid Winter Grant Scheme, they have updated their analysis. The evidence suggests that it should increase spending on food, and reduce hunger and usage of food banks. It may also lead to a fall in obesity and an improvement in children’s performance at school.

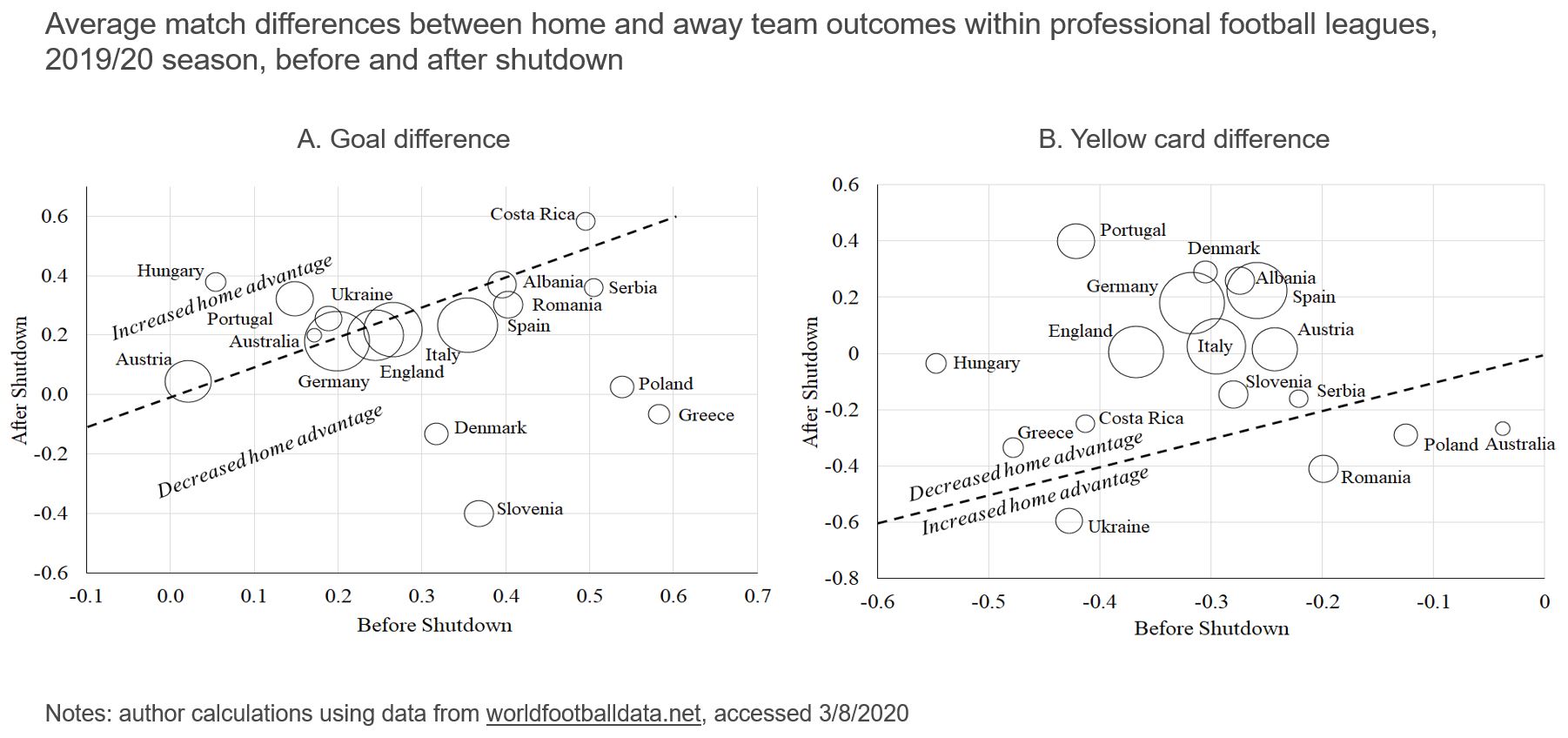

Today’s Observatory piece continues the theme of football rather more explicitly, looking at how the sport is coping with the crisis. A summary of the latest evidence by James Reade, Carl Singleton and Peter Dolton indicates that playing without spectators prevents matches from becoming Covid-19 super-spreaders, but it has potentially devastating financial consequences for lower tier clubs. The empty stadiums are also revealing the influence of crowds on refereeing decisions – in particular reducing the social pressure on refs to punish the home team more harshly and thereby diminishing home advantage.

Finally, a reminder

We are looking for a Data Editor to join the ECO team. We need someone who loves working with data, enjoys coming up with creative ways to present ideas and can quickly develop news skills and techniques. Please pass this on to anyone you think might fit the bill.