Has the Bank of England been ‘printing money’ to pay for government programmes to tackle the economic damage from the coronavirus crisis? No: it is useful to understand the division of responsibilities between fiscal policy and monetary policy – and why it exists.

The high costs of emergency fiscal supports and lost tax revenue in the current crisis mean that the UK government is likely to run a deficit of at least 10-15% of GDP in 2020/21. This would be larger than the deficit following the 2008/09 financial crisis – and any additional costs of future policies to stimulate demand are still to come.

Such projections have led many to ask whether there are alternative ways to finance this support that might avoid a long period of fiscal adjustment after the worst of the crisis is over. For example, why can’t we just print the money? Or – as it’s sometimes more formally put – can’t the government use direct ‘monetary financing’?

To understand why most countries don’t pursue the option of printing money, it is useful to understand how policy institutions typically split responsibilities for macroeconomic policies, as well as why that split exists.

Who controls UK macroeconomic policy?

Since the 1990s, most OECD economies (including the UK) have broadly followed an approach to macroeconomic policy called ‘the new macroeconomic consensus’. In this approach, responsibility for the fiscal and monetary policies is separated between the government and the central bank.

The government is responsible for fiscal policy, setting taxes and deciding on government spending plans, such as how much to devote to different priorities – all of which in the UK is decided by the finance ministry, HM Treasury. The central bank – in the case of the UK, the Bank of England – is given operational independence from the government with responsibility for monetary policy to achieve a government-set inflation target (inflation measures how prices are changing).

This separation of duties has been the case in the UK since the Bank of England was granted independent control of monetary policy in 1997. The inflation target is currently 2% per year for the CPI (consumer price index).

To control inflation, the central bank typically controls the interest rate. Although this is not an exact science, raising interest rates tends to increase the cost of borrowing funds, which in turn reduces how much households consume and how much firms invest; the lower economic activity reduces the pressure on prices to rise. Lowering rates has the opposite effect.

Before central banks became independent, one concern was that governments would put pressure on them to provide too much monetary support to the fiscal authority and the result would be inflation running persistently higher. It was evidence published in the early 1990s that showed that central bank independence was associated with lower and less volatile inflation (Alesina and Summers, 1993). The separation of responsibilities of the government and central bank was seen as a credible way to allow the central bank to control inflation.

What is the evidence that too much money is inflationary?

Inflation is costly because it erodes the value of money: if you earn 2% more but prices go up by 5%, your earnings actually have less purchasing power – you are worse off. But higher levels of inflation are also increasingly unstable, which makes it more difficult to plan. The cost of the inflation depends on the amount of inflation.

Inflation in the UK has been consistently less than 10% since 1982, and more recently it has been mostly below 5%. But there are examples of countries that have experienced such high rates of inflation that it is called hyperinflation. These are countries in which governments have chosen to finance their spending through monetary financing rather than raising tax revenue or borrowing to pay back in the future.

Recent examples are Zimbabwe (2008) and Venezuela (2018). As an illustration of how out of control price increases were, inflation in Zimbabwe got so bad that prices were doubling every day on average. Under such a scenario, long-term contracts break down and shops tend to suffer from major shortages of goods to sell. Hyperinflations are extremely damaging for the economy and people’s wellbeing.

So central banks are tasked with keeping increases in prices under much greater control. The main reason is that it is generally agreed among economists that while monetary policy might boost (or suppress) economic activity in the near term, the ultimate effect of having too much monetary support is inflation. And too little monetary support can lead to deflation.

So how does the government fund itself?

The main way that governments fund their spending is through tax revenue. But sometimes they choose to spend more than they are raising in tax revenue (a fiscal deficit).

Direct monetary financing would involve the government financing its deficit by printing money – or asking the central bank to do so.

Under the separation of responsibilities, a government with a deficit must borrow to cover its expenditure, which increases government debt. This is called bond financing because the government issues debt contracts (bonds) that promise to make certain fixed payments over the life (maturity) of the bond. Bonds are typically bought by financial investors such as asset managers, insurance companies and banks, which hold them as part of their portfolio of investment assets.

In the UK, the Debt Management Office (DMO) works to ensure the most cost-effective financing of the government’s debt obligations. Like any borrower, the government pays a return, and the DMO offers new bond contracts to investors in what is called the primary market; these debt issuances raise funds for the government.

Once issued, there is a secondary market in which investors can buy and sell government bonds. Of course, when one investor in the secondary market sells their bond to another investor, there is no new funding given to the government (although the fixed payments from the bond will now have to be paid to the new owner of the bond.)

Doesn’t the central bank also buy these government bonds? Isn’t that direct financing?

Central banks, like many other financial institutions, hold portfolios of assets. In general, central banks hold less risky portfolios of assets and therefore they have a relatively high proportion of government bonds (which are typically considered relatively safe investments in most countries).

But they make these purchases independently: not directly to finance the government’s borrowing needs but rather for their own operational needs. In particular, if the central bank makes a purchase of bonds, they do so in the secondary market and therefore their purchases transfer money to the seller who is not the government. Direct monetary financing would involve the central bank creating money, which is transferred either directly to the government or via outright purchases of bonds in the primary market.

Has the Bank of England just started directly financing the government?

The Bank of England was originally a private bank established to be the government’s bank. Despite now being operationally independent in pursuit of the inflation target, the Bank of England remains the banker to the government for wholesale banking operations. This means that the government has a number of bank accounts at the Bank of England, and the Bank of England works closely with the DMO too.

While the government has mostly relied on the DMO’s cash management operations to meet its short-term cash needs since 2000, it sometimes needs an overdraft in order to borrow short-term funds. The Bank of England continues to provide an overdraft facility to the government via what is called the ‘Ways and Means’ facility. This facility was the primary method of cash management before the DMO was created. Use of the Ways and Means is equivalent to the issuance of a short-term bond bought directly by the central bank.

A recent announcement about this facility on 9 April 2020 attracted some media attention. It was announced that the Bank of England and HM Treasury agreed to extend the Ways and Means account usage from the normal level of around £0.4 billion. Many commentators speculated that monetary financing was beginning in the UK.

But this is not direct monetary financing in the traditional sense – and it should not lead to inflation:

- It represents a temporary cashflow management tool mainly to avoid disruption in the sterling money market, which is the market for short-term borrowing and lending. The ebb and flow of activity in this market is crucial to the Bank of England as it helps transmit its decision immediately, resulting into changes to the UK prices and the broader economy.

- HM Treasury keeps using the markets as its primary source of financing, but the Ways and Means facility makes it possible to issue bonds at the best time.

- It is typically of too small amount and temporary compared with what could normally be understood as monetising public debt.

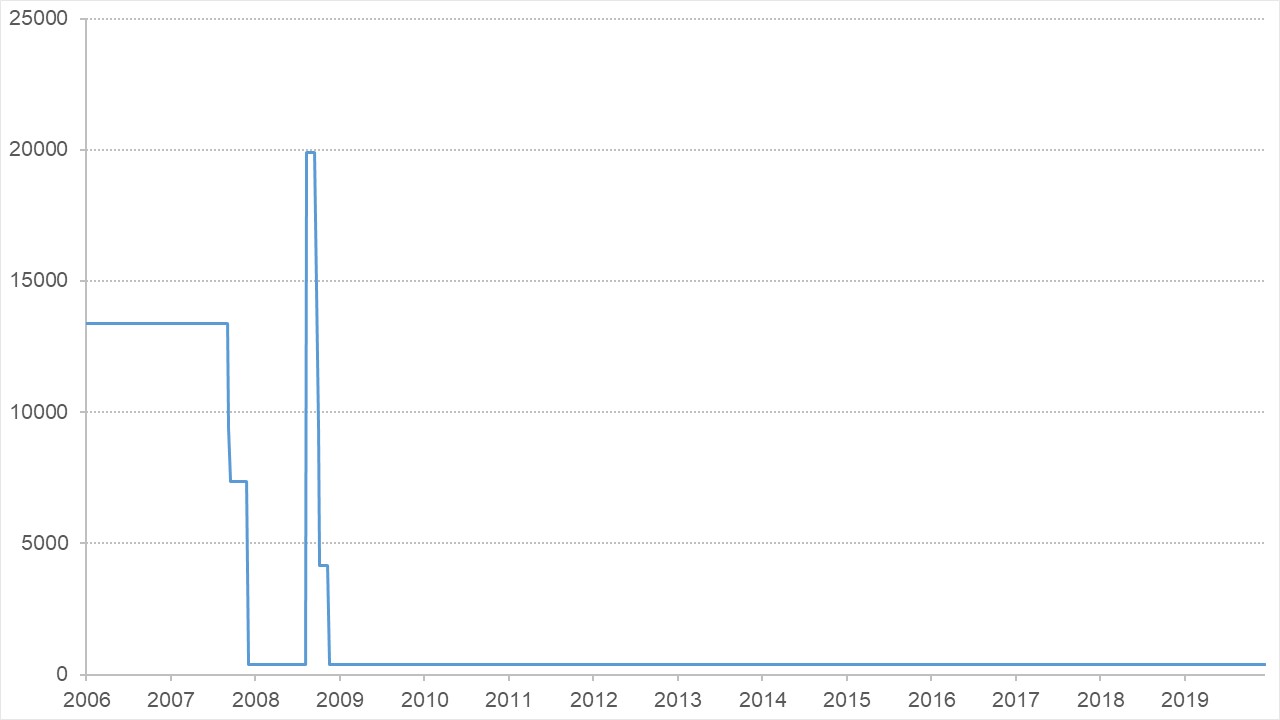

Figure 1 shows the weekly amounts outstanding in the Ways and Means account (advances to HM Treasury) in millions of pounds. Two things stand out:

- Usage at the start of the 2008/09 global financial crisis amounted to nearly £20 billion and it was relatively quickly repaid.

- As of 18 May 2020, the government has not increased its use of the facility despite the announcement in April. The facility has, so far, more as a guaranteed credit line than an advance.

Figure 1: Balance on the Ways and Means Account (24 May 2006 - 18 May 2020)

Source: Bank of England

In a 1974 interview in The Guardian, (now) Dame Frances Cairncross asked Milton Friedman: ‘Why do you think governments have followed policies that have proved to be inflationary?’ His reply included that ‘Inflation is the one form of taxation that can be imposed without legislation. It is also a form of taxation that is particularly seductive. In its early stages, people find it rather attractive, because the first effects of inflation are expansionary and pleasant. It’s like the first drink you take. It’s only the next morning that you have a hangover.’

The UK’s macroeconomic framework is designed to prevent such use by the government of direct monetary financing – and attractive as it might seem in the short term, there are no signs so far that the Covid-19 crisis has changed that arrangement.