Big increases in government borrowing and total public sector debt have been an essential policy response to the health and economic effects of Covid-19. But such rises are not unprecedented – and we can learn from past experiences about how best to deal with the challenges that they pose.

To deal with the pandemic, the UK government has had to borrow a lot of money, expected to rise to around 15% of GDP this year (Office for Budget Responsibility, 2020). The last time we saw borrowing on this scale in the UK was during the Second World War (Thomas and Dimsdale, 2017).

The total amount of public sector debt is expected to rise to around 93.5% of GDP (Lenoël and Young, 2020), up from 81.7% last year. But national debt on this scale is far from unprecedented in a historical context – the debt-to-GDP ratio exceeded 200% at the time of the Napoleonic Wars and the Second World War (Thomas and Dimsdale, 2017). History offers useful lessons for reducing high public debt ratios.

What does evidence from economic research tell us?

- Governments can finance expenditure by raising revenue or by issuing debt. When expenditure is financed by issuing debt, a key question is whether to issue short- or long-term bonds. Analysis of the UK national debt over the last century suggests that short bonds as opposed to long bonds would have been the most cost-effective way to finance debt, even after accounting for various risks (Ellison and Scott, 2020).

- In the UK, at times of high public debt (such as the aftermaths of the Napoleonic Wars and the two world wars), success or failure to reduce the debt has mainly depended on ‘fiscal effort’ (the balance between government revenue and expenditure) and ‘automatic debt dynamics’ (trends in interest rates and economic growth).

- In the nineteenth century, fiscal effort was key in reducing the debt. After the First World War, fiscal effort was offset by unfavourable automatic debt dynamics. Between 1950 and 1970, automatic debt dynamics were crucial (Crafts, 2016).

- Beyond the UK, fiscal effort and the automatic debt dynamics were of roughly equal importance in large public debt reductions in advanced economics between 1880 and 2007 (Abbas et al, 2011).

Reducing debt in detail

There is a substantial body of economic research showing how public debt ratios have been managed in the past. A simple accounting formula is widely used to account for changes in the public debt to GDP ratio, which breaks down changes into three terms: the primary balance, the growth-interest differential and the stock-flow adjustment (Abbas et al, 2011).

Also known as fiscal effort (Eichengreen et al, 2019), the primary balance is government revenue less expenditure excluding gross interest payments (Escolano, 2010). The logic is that a primary surplus allows governments to repay debt, all else equal. It is this channel on which much public discussion focuses.

The growth-interest differential, sometimes referred to as the automatic debt dynamics, is the difference between the effective interest rate on debt and nominal GDP growth (Abbas et al, 2011). The intuition is that a fall in the interest rate will reduce the debt burden, as will a rise in the growth rate of nominal GDP because of an increase in the denominator of the debt-to-GDP ratio, all else constant. This channel is less widely appreciated by the general public.

The stock-flow adjustment captures the difference between the actual change in the debt and the sum of the primary balance and the growth-interest differential. This residual captures valuation effects on debt issued in foreign currency, measurement error, and ‘below-the-line’ measures such as privatisation and debt restructuring or default (Eichengreen et al, 2019).

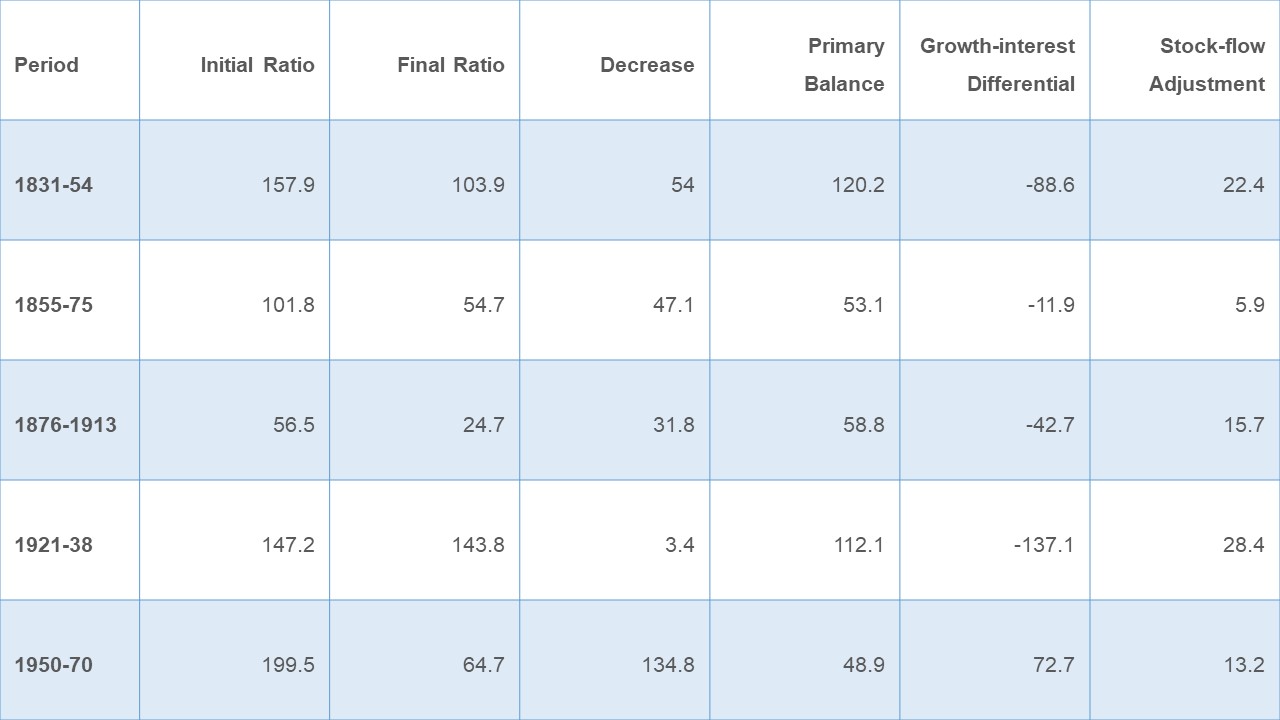

In the UK, high public debt ratios have been reduced in several ways. Table 1 shows that before the First World War, budget surpluses were the main force lowering debt, whereas the growth-interest differential was unfavourable and raised the debt ratio (Crafts, 2016; Eichengreen et al, 2019). For example, between 1831 and 1854, debt from the Napoleonic Wars was lowered from 157.9% of GDP to 103.9%, of which the primary balance accounted for 120.2 percentage points of the decline, the growth-interest differential -88.6 and the stock-flow adjustment 22.4 (Crafts, 2016).

In the interwar period, debt amassed during the First World War was stuck at a high level despite primary surpluses because the effective interest rate exceeded the nominal growth rate, which was checked by depression and deflation (Crafts, 2016).

In the post-war period, a decrease in the debt-to-GDP ratio of 134.8 percentage points was achieved between 1950 of 1970, of which 48.9 percentage points were due to primary surpluses, 72.7 percentage points to the growth-interest differential and 13.2 percentage points to the stock-flow adjustment. Therefore, the main weight on the debt was the favourable growth-interest dynamics. High growth was achieved against the backdrop of the ‘Golden Age’ of European growth, while low effective interest rates were ensured by a policy of ‘financial repression’ (Crafts, 2016).

Table 1: Decomposition of changes in the UK’s public debt ratio

Source: Reproduced from Crafts (2016).

Internationally, a study of 61 non-default debt consolidation episodes of more than 10% of GDP in 19 advanced economies between 1880 and 2007 showed that of an average decline of 37.8% of GDP, the primary surplus accounted for 21.5 percentage points, the growth-interest differential 19.5 percentage points and the stock-flow adjustment -3.2 percentage points (Abbas et al, 2011).

While the split between the primary surplus and growth-interest differential was roughly equal on average, fiscal effort did most of the work before 1945, as well as after 1970, while automatic debt dynamics were central between 1945 and 1970.

How reliable is the evidence?

The reliability of the evidence is high. The research is mainly published in high-quality peer-reviewed academic journals. But there are some areas of uncertainty.

One issue is data quality. While fiscal data are relatively reliable in a historical perspective, historical national accounts are less so. The potential impact of measurement error on the results is ambiguous.

Another issue is the interdependence between the terms in the debt decomposition. For example, economic growth may not only affect the debt-to-GDP ratio directly but also indirectly via the primary balance, by affecting certain revenues and expenditures, such as tax receipts (Mauro and Zilinksy, 2016). As a result, the contribution of economic growth in public debt consolidations may be underestimated by previous research.

Similarly, the primary balance may affect the growth-interest differential. If fiscal policy affects interest rates or economic growth through possible crowding-out effects, for example, then the contribution of the primary balance may also be miscalculated.

What else do we need to know?

The primary balance has been important in managing high debt episodes of the past. But previous research has not investigated whether this was achieved by spending cuts, tax hikes or a combination of the two. This is of first-order importance to policy-makers attempting to reduce debt by fiscal effort.

A more accurate estimate of the contribution of economic growth in historical debt consolidations is needed to address concerns that economic growth has an uncounted, additional effect on debt through the primary balance (Mauro and Zilinksy, 2016).

Does high debt matter? The impact of debt on economic performance is a highly contentious issue. If excessive public debt has major macroeconomic implications, then reducing the debt is important. If high public debt has minor consequences, then it may be that the debt-to-GDP ratio can be maintained at a high level. Ultimately, this remains an open but complicated empirical question.

Where can I find out more?

Historical patterns and dynamics of public debt – evidence from a new database: Ali Abbas, Nazim Belhocine, Asmaa El-Ganainy and Mark Horton investigate the causes of large increases and decreases in public debt in advanced economies since the nineteenth century.

Public debt and low interest rates: Olivier Blanchard argues that public debt may have low fiscal and welfare costs at times of low interest rates.

Reducing high public debt ratios: lessons from UK experience: Nicholas Crafts studies how the UK public debt has been reduced in the past.

Public debt through the ages: Barry Eichengreen, Asmaa El-Ganainy, Rui Esteves and Kris Mitchener recount the history of sovereign debt.

323 years of UK national debt: Martin Ellison and Andrew Scott analyse the historic management of the public debt in the UK.

Public debt episodes in Irish economic history 1950-2015: Seán Kenny studies high debt episodes in Ireland’s modern economic history.

Who are UK experts on this question?

- Nicholas Crafts, University of Sussex, has investigated how the UK has reduced high debt ratios in the past.

- Martin Ellison, University of Oxford, has studied the funding of the First World War and the management of the national debt.

- Roger Middleton, University of Bristol, has worked on the history of British economic policy.

- Andrew Scott, London Business School, has also studied the funding of the First World War and the management of the national debt.

- Martin Slater, University of Oxford, has written a history of the national debt in the UK.