While the Covid-19 recession has some unique characteristics, research on past experiences of economic downturns offers valuable lessons on how long recovery takes and what policies might accelerate that process.

The UK economy is in a recession because of Covid-19. Two characteristics make this recession unique. First, nearly every economy across the globe is experiencing it simultaneously. Second, the Covid-19 recession is self-induced – economies have in effect been put into a temporary coma to deal with the pandemic.

Despite today’s unique characteristics, past recessions can teach us something about what to expect in terms of how long it takes to exit from a recession and what, if any, policies might accelerate that exit. Using newly created databases of long-run macroeconomic statistics, recent economic research has investigated these issues.

What does evidence from economic research tell us?

- Across advanced economies over the past 150 years, the average length of a recession was one and a half years. The average fall in real GDP per capita was 2.5% per annum.

- Recessions that are preceded by or associated with financial crises and credit booms are much more damaging to the economy than recessions that are not.

- Monetary and fiscal stimulus have an important role to play in exit strategies, but care needs to be taken that the stimulus is not withdrawn too early.

- The ability of governments to address a recession is limited if a country enters a recession with high levels of public debt. In addition, large public debt that emerges during recessions has acted as a drag on long-run economic growth.

- Productivity, which had slowed dramatically in the UK and elsewhere in the decade prior to the Covid-19 outbreak, is the key to economic growth in the short and long run.

How reliable is the evidence?

The evidence is predominantly from peer-reviewed journals, using high-quality data accumulated over the past 50 years. The Macrofinance Lab has created a macrohistory database of annual data for 17 advanced economies stretching back to 1870. For the UK, the Bank of England has created A Millennium of Macroeconomic Data.

Using the Macrofinance Lab data, one study shows that the average recession in advanced economies over the past 150 years lasted one and a half years and real GDP per capita fell by an average of 2.5% per annum (Jordà et al, 2017). Although there is little difference in the duration of recessions before and after 1945, recessions since 1945 have not been as deep, with GDP per capita falling by an average of 1.7% per annum in post-1945 recessions, compared with 2.9% for pre-1945 recessions. This difference is possibly explained by the severity of the Great Depression of the 1930s and by the greater use of monetary and fiscal stimulus in post-1945 recessions.

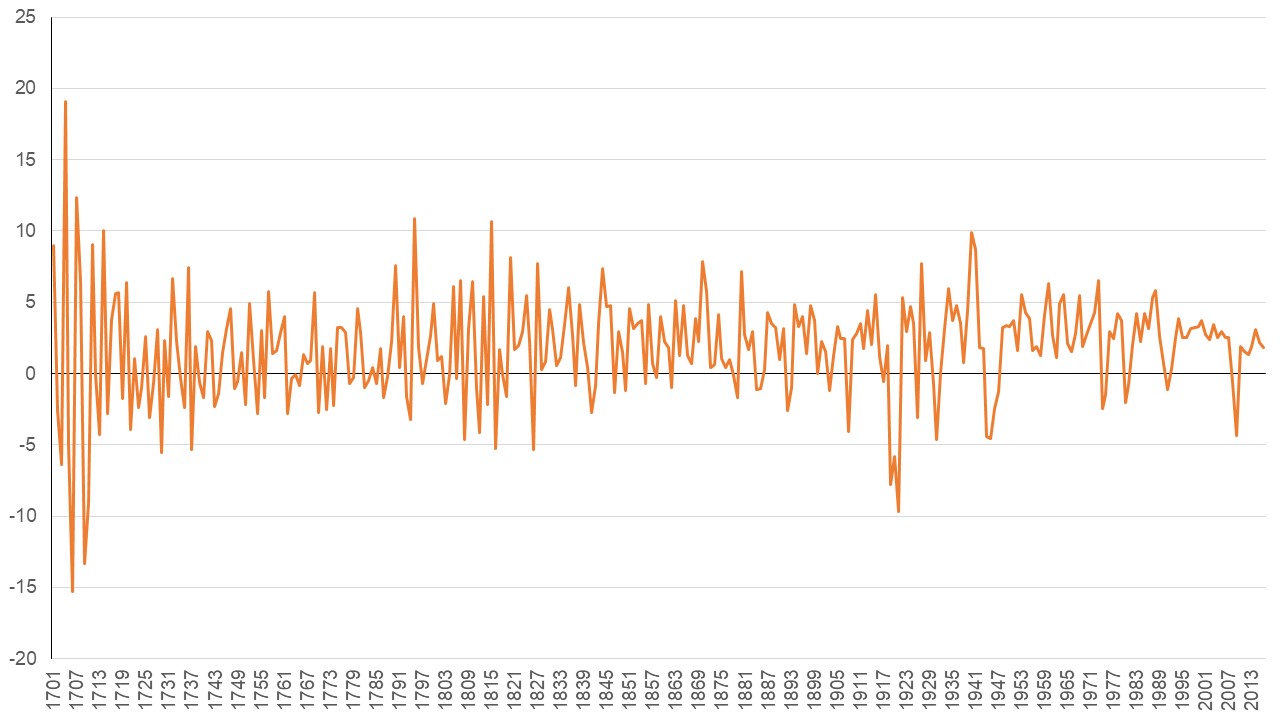

The Bank of England’s database contains UK GDP figures back to 1700 and, thanks to recent research, it has GDP figures for England back as far as 1270 (Broadberry et al, 2015). Measurement error becomes more of an issue the further back in time we go, so these data must be treated with a modicum of caution. According to the Bank’s database, between 1700 and 2016, UK GDP contracted in 92 years out of 316 (see Figure 1). The average contraction in annual GDP during these 92 years was 2.5%, ranging from a fall of 15.32% in 1706 to 0.03% in 1900.

As Figure 1 shows, recessions have diminished in frequency over time; but over the past century, their severity has increased (Hills et al, 2010; Dimsdale and Thomas, 2019). Precise dating of UK contractions from the 1850s onwards suggests that contractions since then have averaged 26 months and ranged from two to 81 months in length (Chadha et al, 2000).

Figure 1: Annual changes in real GDP for the UK, 1701-2016

Source: Bank of England

The experience of the 2008 global financial crisis, as well as the well-known book by Carmen Reinhart and Kenneth Rogoff (2009), suggests that recessions triggered by financial crises can be very costly. This was certainly the case with the Great Depression, which was particularly severe in the United States compared with the UK because of the former’s episodic bouts of banking panic during the early 1930s (Crafts and Fearon, 2010).

This relationship between banking stability and output has been borne out in a recent study that examines the effect of UK banking failures on output for the period from 1750 onwards (Lennard et al, 2017). Another study, which uses the Macrofinance Lab data, finds that after 1945, recessions that were preceded by financial crises have been twice as costly as normal recessions (Jordà et al, 2011). Recessions that follow credit booms are also more costly (Schularick and Taylor, 2012).

The evidence on the role of policies that can support exit from recessions suggests that monetary policy has become more aggressive in recent history, particularly when the recession has been preceded by a financial crisis (Hills et al, 2010; Schularick and Taylor, 2012). Indeed, one major lesson from past UK recessions is that governments and central banks could have reduced the depth of recessions by as much as half had they known what we know today about the efficacy of monetary and fiscal policy during recessions (Dow, 1998).

Lessons on how to exit recessions from the most studied recession in history – the Great Depression in the United States – may be more along the lines of negative lessons, that is, what not to do (Middleton, 2010). But there is also evidence to suggest that monetary policy played a major role in bringing the United States out of the Great Depression (Romer, 1992). Fiscal policy was not used much during the Great Depression, possibly because of constraints arising from adherence to the gold standard and an overhang of high wartime debt (Crafts and Fearon, 2010).

The Great Depression also provides a salutary lesson on withdrawing monetary and fiscal stimulus injected during a recession too soon. The United States experienced a large double-dip recession in 1937, which had been preceded by a tightening of monetary and fiscal policy (Velde, 2009; Mitchener and Mason, 2010).

Nevertheless, there can also be a cost to not removing stimulus after a recession, particularly if there is a large overhang of public debt. Two studies that analyse two centuries of data from 44 countries show that high levels of public debt can act as a major drag on economic growth (Reinhart and Rogoff, 2010, Reinhart et al, 2012).

But the more controversial claims made by these studies, particularly with respect to what constitutes a high level of debt, have been challenged (Herndon et al, 2013; Panizza and Presbitero, 2014). Furthermore, because fiscal policy is such a valuable weapon in exiting recessions, governments must re-establish their reputation for fiscal prudence so that they are able to combat the next recession.

Although advanced economies have experienced numerous recessions over the past 250 years, consistent improvements in productivity have created an engine for continued economic growth and dramatically improved standards of living. Consequently, exploring the drivers of productivity and how these change after recessions is key to understanding long-run economic growth and prosperity (Chadha and Nolan, 2002).

The concern as we emerge from the Covid-19 recession is that productivity in the UK and in other advanced economies had been flatlining since the 2008-09 recession (Haldane, 2018; Crafts and Mills, 2019). Resolving this productivity problem will be a key to the UK’s exit from recession.

What else do we need to know?

We know the speed of exit from historical recessions as well as their length and the depth. But we do not know for many countries the precise dating of historical recessions at a monthly or even quarterly frequency.

We also know that recessions that are associated with financial crises are more severe. But we do not know, in a systematic fashion, the causes of past recessions and whether the length and depth of recessions vary depending on their causes.

We also do not know, in a systematic manner, what policies have worked best to exit recessions. Addressing this issue will be complex because policy levers, policy space and the degree of democracy have varied greatly over the past two centuries.

Where can I find out more?

Returning to growth in the UK: Policy lessons from history: Nicholas Crafts examines recovery and the policy lessons from severe recessions in the 1930s and 1980s.

An historical perspective on the Great Recession: Nicholas Crafts suggests that looking back to past experiences prevented the global financial crisis turning into an even deeper recession.

A recession to remember: lessons from the US, 1937-1938: Nicholas Crafts and Peter Fearon argue that exit strategies need to focus on providing monetary support as fiscal stimulus is withdrawn.

Diminished expectations, double dips, and external shocks: the decade after the fall: Carmen Reinhart and Vincent Reinhart suggest that the decade after recessions can be marked by lower growth as well as a risk of double-dip recessions.

Debt and growth revisited: Carmen Reinhart and Kenneth Rogoff argue that high levels of debt stunt economic growth.

Fact-checking financial recessions: Moritz Schularick and Alan Taylor suggest that credit booms and financial crises are associated with more severe and prolonged recessions.

The normality of extraordinary monetary reactions to huge real shocks: Stefano Ugolini explores historical extraordinary monetary policy reactions to large real shocks.

Who are UK experts on this question?

- Jagjit Chadha, National Institute of Economic and Social Research, does research on monetary policy during the Covid-19 crisis

- Nicholas Crafts, University of Sussex, does research on fiscal policy in a depressed economy

- Natacha Postel-Vinay, London School of Economics, does research on credit booms and the US Great Depression

- Ryland Thomas, Bank of England, does research on recessions and the Bank’s historical macroeconomic database