Bold fiscal policy has aimed to mitigate the collapse in UK economic activity, but the recession makes the public finances more precarious. How can we assess the fiscal consequences of the crisis – and the interplay between fiscal measures and the macroeconomy?

Early estimates suggest that the UK economy contracted by 25% in the first months after the introduction of lockdown measures. This crisis has elicited a policy response that is unprecedented in terms of size and scope to mitigate the impact on companies and households. Inevitably, the collapse in economic activity and the provision of extraordinary fiscal measures have important implications for the country’s public finances, driving a surge in government borrowing and debt. This article considers how we can assess the fiscal consequences of the crisis.

How important are automatic fiscal stabilisers?

One of the important roles of fiscal policy is to help to reduce fluctuations in demand. To support economic stability, the government absorbs some of the risks of income volatility faced by individual households and firms.

Many fiscal policy instruments act to soften the blow of economic downturns and restrain the economy when it overheats. For example, when job and spending levels are high, tax payments – which are linked to current income – rise, and fewer households receive benefits such as unemployment insurance.

Conversely, during a downturn, when more workers lose their jobs, tax payments decline and benefit payments rise. As such, it is no surprise that the public finances deteriorate in an economic downturn, as this is essentially by design. Often referred to as ‘automatic fiscal stabilisers’, these instruments do not require any change in the tax code or other legislation, which generally entail a considerable time lag (see van den Noord, 2000, for more on automatic stabilisers).

Forthcoming OECD estimates show that automatic stabilisers in the UK tend to offset over half of the impact of a shock to disposable income, with lower direct taxes offsetting about 30% of the decline, higher unemployment, housing and other benefit payments offsetting a further 10-15%, and the remainder coming from lower social security contributions paid by employees (see Caldera et al, 2020). So however dramatic the current drop in household income, the impact would have been far worse in the absence of these stabilising instruments.

The impact of a decline in output on public borrowing via automatic stabilisers depends on the type of shock the economy faces, and how that shock affects the different tax revenue bases and benefit recipients. For example, where the shock originates from household’s reduced willingness to spend (a consumption demand shock), the main impact will be on indirect tax revenue such as VAT. Alternatively, a disruption to business production capacity (a supply shock) would be likely to hit employment and will affect direct income tax revenue and unemployment benefit payments. Finally, an external shock that reduces exports may reduce corporate tax revenue.

Related question: Is the Covid-19 recession caused by supply or demand factors?

In the current crisis, we find ourselves in the unfortunate position of facing severe negative shocks along all these dimensions, and the public finances have been heavily affected across the board.

Estimates for the 2020/21 financial year as a whole suggest that the deficit will rise by £100-150 billion (4.5-7% of 2019 GDP) as a result of the drop in economic output and operation of existing automatic stabilisers (Emmerson et al, 2020; Gardiner et al, 2020; Office for Budget Responsibility, Coronavirus reference scenario).

How will new discretionary measures affect the public finances?

Given the magnitude and specific nature of the macroeconomic fallout from the Covid-19 crisis, automatic fiscal stabilisers in most countries were neither sufficient nor particularly well-designed to handle the shock (Doyle, 2020).

As such, the UK government initiated an extraordinary set of discretionary measures to mitigate the impact of the crisis on companies and workers. In terms of magnitude, the package amounts to about 8.5% of GDP, which compares with fiscal support of about 2% of GDP at the height of the global financial crisis. These new discretionary policy measures will more than double the impact on the public finances of the automatic stabilisers.

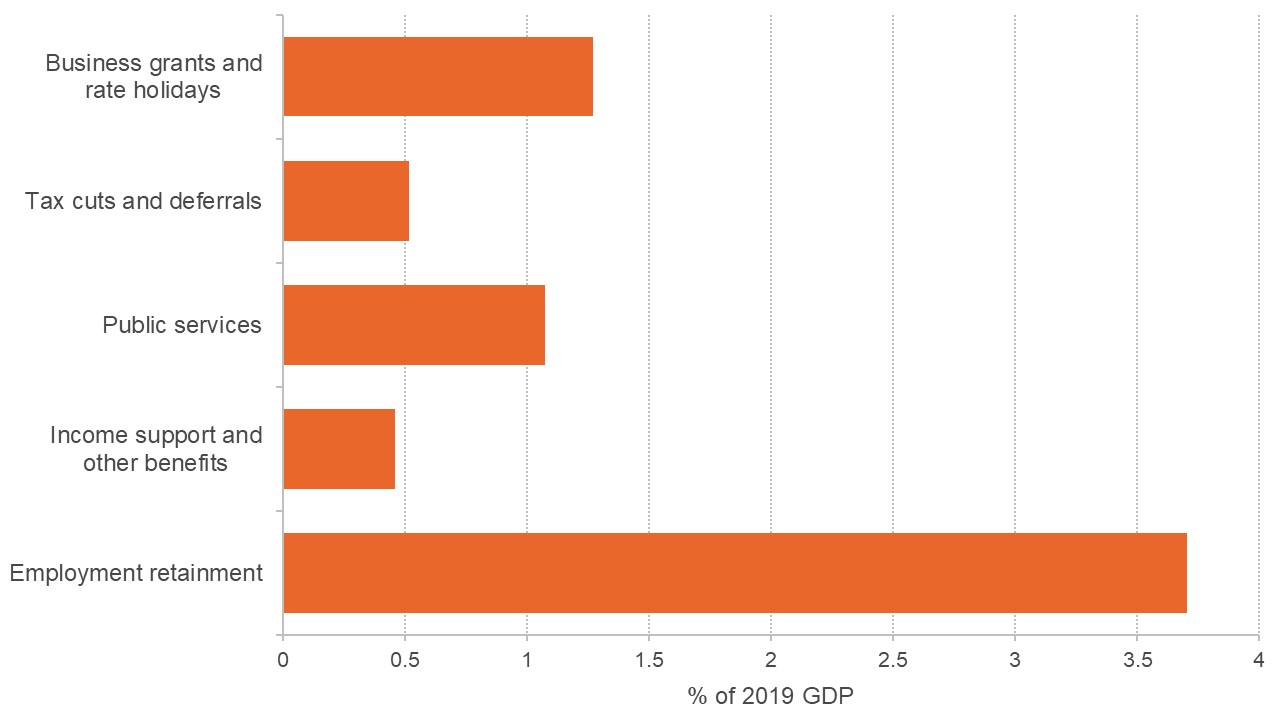

The measures can be broadly grouped into employment retainment policies; income support and other benefits; measures to strengthen public services; tax cuts and deferrals; and business grants and rate holidays. Figure 1 illustrates the relative magnitude of measures within these groups.

In addition, the government has made available £330 billion (about 15% of GDP) in loans and state-backed loan guarantees to support firm liquidity. While this will not have an immediate impact on the UK's public finances, it represents a contingent liability that may add to government borrowing in the future if some businesses are unable to repay their loans. (See Pope and Tetlow, 2020, for an overview of policy measures introduced up to 9 June 2020 and HM Treasury, 2020, for new measures announced on 7 July.)

Figure 1: Estimated impact of discretionary measures on 2020/21 public sector borrowing

Source: Calculations based on OBR Coronavirus policy monitoring database 19 June 2020 and A Plan for Jobs 2020.

Note: The figure is benchmarked relative to the level of GDP in 2019, given the enormous uncertainty surrounding 2020 estimates.

There is a wide margin of error around the cost estimates illustrated in Figure 1, which should be used as a guide rather than a forecast. Sources of error include uncertainty over the scale and duration of the pandemic, the pace at which public health restrictions are lifted, the level of uptake of various programmes, the effectiveness of policy measures and economic response, and potential policy changes over the coming months. Given the enormous level of uncertainty, the majority of forecasting institutions have taken to presenting a series of alternative scenarios for the outlook rather than a single forecast.

The priorities of the discretionary measures have been to support incomes, prevent bankruptcy of viable firms and maintain the links between employees and employers.

Employment retainment measures comprise the largest share of new discretionary measures, and represent a new set of instruments that have never before been implemented in the UK. The Coronavirus Job Retention Scheme (CJRS) encourages businesses to furlough employees rather than lay them off, by providing a grant to cover up to 80% of the employee’s usual monthly wage costs. (See Adam, 2020, and Bell et al, 2020, for details on the CJRS.)

Related question: How does the government's furlough scheme work?

A similar scheme has been set up to support the self-employed (SEISS). As of 5 July, 9.4 million jobs had been furloughed, and 2.7 million claims had been made through the self-employment scheme, so that together the schemes are supporting over 35% of the workforce. This compares to a rise in the claimant count of 1.5 million between March and May.

Related question: How is coronavirus affecting the self-employed?

Preserving the connection between employees and employers, compared with a situation of mass lay-offs with income supports provided through unemployment benefits, both improves the sense of job security for the employees, and has important implications for the potential speed of economic recovery as social distancing measures are eased.

Businesses have experienced staff ready to kick start operations as soon as their doors re-open for business, without the costs and time lag associated with advertising, hiring and training new employees. Employees have remained connected to the workforce, and will avoid a time-consuming job search and the detrimental impact of long periods out of work on their skills and pay prospects.

While the price tag on employment retainment measures is high, over the longer term, a more rapid recovery and lower levels of long-term unemployment will help to prevent greater fiscal damage.

Related question: How can we protect young people from being scarred by coronavirus?

So exactly how big is the deficit?

Estimates for public sector net borrowing this year are in the range of 10-17% of GDP, under an assumption that lockdown measures continue to be gradually withdrawn and economic activity can resume. In the event of a second wave, borrowing could soar even higher. While there is considerable uncertainty surrounding the precise size of the fiscal deficit this year, there is no doubt that it will be extraordinarily large, reaching its highest level on record outside periods of war.

Related question: Why is uncertainty so damaging to the economy?

How will we pay for it?

For the most part, this borrowing will be financed by an increase in the issuance of gilts by the Debt Management Office. Government debt already stands at its highest level in over 50 years and will rise further over the coming year.

Yet there is broad consensus among economists that the massive fiscal interventions introduced are necessary, and that by limiting the economic damage suffered in the short term and accelerating the economic recovery, they will ultimately reduce the fiscal costs of the crisis over the longer term, thanks to the extra tax receipts from employees that remain in employment and companies that stave off bankruptcy.

Despite the increase in debt, historically low interest rates mean that government debt remains affordable by historical standards. The government is able to borrow at negative rates for horizons of up to three years and can currently borrow at 50-year maturities for less than 0.5% annually. There have been no signs that the UK government is struggling to finance itself, as gilt auctions are consistently oversubscribed and on some issuances yields have turned negative (Scottish Government, 2020).

As long as the government can continue to borrow at very low rates of interest, most economists agree that the temporary spike in borrowing this year is not an immediate concern for the sustainability of the public finances, which will instead depend on the extent to which the current weakness in the economy persists in subsequent years. Stimulating the economy now will help to minimise that persistence.

Where economists disagree is on how and when to tackle the legacy of high debt that the crisis will leave behind. Eventually, it will have to be financed through some combination of future taxes, future spending cuts, strong economic growth or inflation.

In a survey of 30 UK economists by the Centre for Macroeconomics, the majority of respondents believe that there is no need to announce plans to redress the surge in debt until the pandemic subsides (Ilzetzki, 2020). But others raise concerns about rising inflation or a rise in uncertainty that could hamper the economic recovery if a plan for debt reduction is not announced soon.

Muscatelli (2020) and some others favour spreading these costs across several generations, by issuing debt with very long maturity dates (50 or 100 years), or even debt that never matures (perpetual debt). By contrast, Ellison and Scott (2020), identify a distinct cost advantage to issuing shorter-term bonds. Some economists endorse a period of high inflation, perhaps by raising the inflation target of the Bank of England, to help erode the debt burden, although others are more sceptical about the potential for inflation to reduce public debt (Reis, 2017).

Some potential policy instruments include temporarily freezing public sector pay; rethinking the indexation of public pensions; or raising taxes on income or wealth. But many economists warn that attempting to balance the budget too early, before the economy has recovered from this dramatic shock, will ultimately prove self-defeating, by undermining economic growth and productivity (Bagaria et al, 2012; Bardaka et al, 2020; House et al, 2019).

Historically, large UK debt burdens have been eroded through a combination of fiscal consolidation efforts as well as strong economic growth.

Related question: What can we learn from the past about how to pay for the crisis?

The appropriate policy mix will depend on a combination of political and economic concerns, and will no doubt form a key focus of economic and political debate for much of the coming decade.

Where can I find out more?

Strengthening automatic stabilisers could help combat the next downturn: Aida Caldera and colleagues at VoxEU.

Fiscal policy for the coronavirus maelstrom: Peter Doyle on the National Institute of Economic and Social Research (NIESR) blog.

The outlook for the public finances under the long shadow of Covid-19: Carl Emmerson and colleagues at the Institute for Fiscal Studies.

Covid-19 and UK public finances: Ethan Ilzetzki summarises the findings of a survey of UK economic experts.

Paying for coronavirus will have to be like war debt – spread over generations: Anton Muscatelli writing at The Conversation.

Coronavirus: impact of government response on public borrowing: Thomas Pope and Gemma Tetlow at the Institute for Government.

GOV.UK, Coronavirus guidance and news.

HMRC coronavirus (COVID-19) statistics (Statistics on Coronavirus Job Retention Scheme, Self-employment Income Support Scheme, VAT payments deferral scheme).

Office for Budget Responsibility (OBR).

Who are experts on this question?

- Dawn Holland

- Jagjit Chadha

- Michael McMahon

- Simon Wren-Lewis

- Andrew Scott

- Carl Emmerson