UK GDP is falling sharply in part because firms are less able to produce goods and services, and in part because consumers aren’t spending as much. Which mechanisms are the most important – and why does this matter for policy-makers?

The Covid-19 pandemic is leading the UK into an extremely large recession. Broadly, economists split the causes of recessions into two categories:

- With a fall in supply, then at prevailing prices, firms’ ability and/or willingness to produce falls.

- With a fall in demand, then at prevailing prices, households and firms want to spend less.

Both supply and demand factors are important in the Covid-19 recession. Illness and lockdowns reduce the ability of people to work, and sectors such as hospitality that involve close human contact have been shut down. These are severe supply disruptions.

Demand has also fallen because social distancing measures and the fear of infection reduce people’s desire to consume such services when they are open for business. Income falls from job losses also reduce people’s ability to spend, and uncertainty about the future causes households and firms to delay spending until that uncertainty is resolved.

Related question: Why is uncertainty so damaging for the economy?

Distinguishing between supply and demand factors is difficult because both lead to falls in production, so we cannot tell them apart from GDP data alone. Research evidence finds a large role for both types of disturbance, but different studies reach different conclusions on which matters most. The UK evidence points to a dominant role for demand.

Related question: How much will lifting lockdown start to reverse the UK's economic slump?

Why do we care about the source of the recession?

Policies that work well in a supply-driven recession don’t necessarily work if the recession is driven by a fall in demand. If, for example, the only thing holding back household spending is that shops and restaurants are not allowed to open fully, then a policy of boosting household income with government money would not be of any help. The priority in that extreme supply-driven scenario should be to find ways to re-open shops quickly and safely – to increase supply.

At the other extreme, policies that boost supply will not be effective if the recession results from insufficient demand. Opening the shops again won’t help if fear and uncertainty mean that consumers don’t want to spend money.

A large body of research finds that monetary policy (such as adjusting interest rates) and government spending (fiscal policy) are most effective in dealing with demand-driven recessions. Monetary policy can increase output in a supply-driven recession, but this comes at the cost of higher inflation (Blanchard, 2006) – for the link between monetary policy and inflation, see here. Government spending is more powerful in recessions driven by demand shortfalls because it reduces the spare firm capacity created by low demand (Ghassibe and Zanetti, 2020).

Related question: 'Monetary financing': is it happening and what are the dangers?

Recent research studying the effects of the specific types of supply and demand disturbances caused by the Covid-19 pandemic finds that monetary policy and untargeted government spending are weaker if the recession is driven mostly by interruptions to supply (Baqaee and Farhi, 2020). If the recession is largely driven by supply disturbances, then the best policy targets the particular supply restriction and tries to reduce it.

A recent study finds that stay-at-home orders targeted at sectors and occupations that can work from home is the best way to mitigate the supply disruption from infections reducing the ability of people to work (Bodenstein et al, 2020). The lockdown reduces infections, and so allows those who cannot work from home to continue to work and remain productive.

The relative importance of supply and demand factors influences which policies will have the largest benefits. Misdiagnosing the source of the recession could actually make the recession even worse.

The data available during the oil crises of the 1970s led policy-makers to believe that this supply-driven recession was actually caused by a shortfall in demand (Orphanides, 2001). The subsequent policy of low interest rates led to very large increases in inflation in excess of what would have happened if policy-makers had correctly identified the source of the recession.

We therefore need to bear in mind that we might reach the wrong conclusion with incomplete real-time information.

Related question: How can we measure what is happening in the economy now?

What is the evidence for the UK in 2020?

One way to explore whether supply or demand is more important in the Covid-19 recession is to compare household spending with labour income. To a first approximation, expenditure represents a proxy for demand, while labour income or earnings can be interpreted as a proxy for supply as it is earned by people being in work and producing.

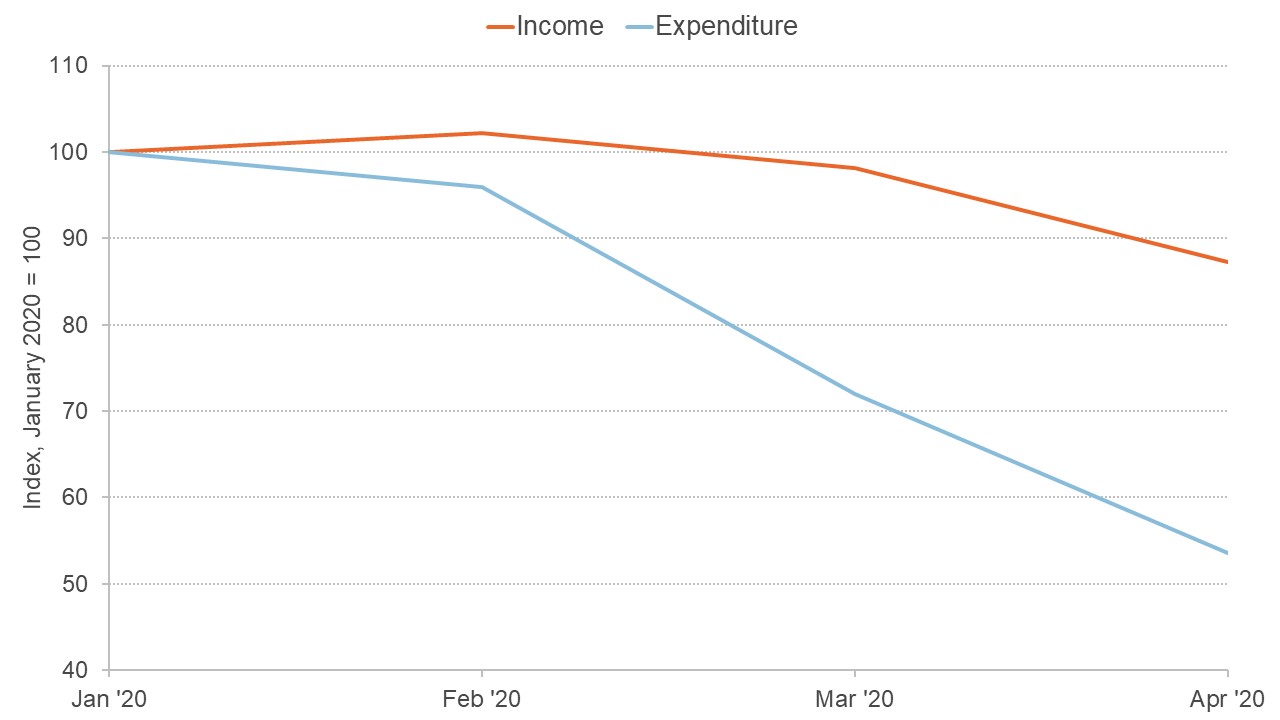

Based on bank account transaction data from a large fintech company in the UK, Figure 1 shows the average monthly expenditure and the average monthly labour income from a sample of British households up to April 2020, relative to their levels in January (Hacioglu et al, 2020).

Figure 1: Average income and expenditure in the UK

Source: Hacioglu et al, 2020.

The fall in household expenditure began before the major falls in labour income, and has been far larger. The drop in consumer spending is already clearly visible in March, when earnings were still close to their January level. This suggests that demand factors matter more than supply. The smaller drop in earnings may partly reflect the government’s Coronavirus Job Retention Act Scheme (CJRS).

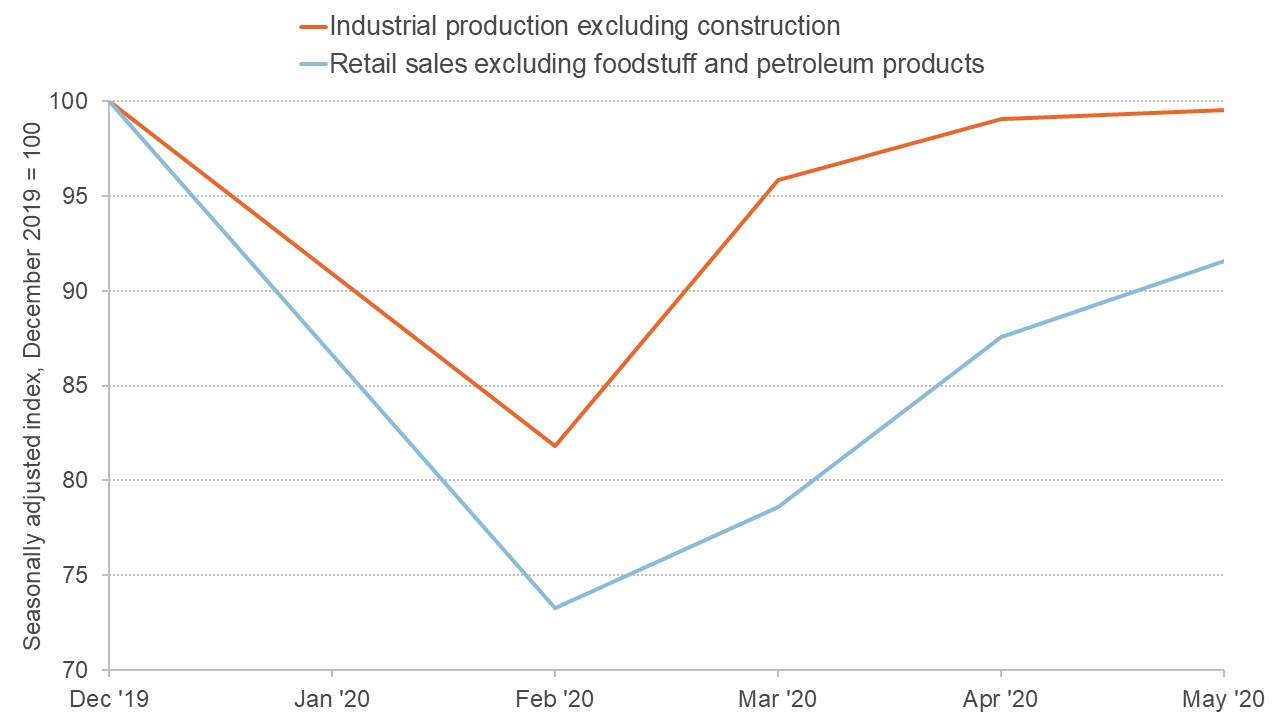

Data from China reveal similar patterns, as Figure 2 shows. The supply side of the economy (approximated here by industrial production) falls by less than the demand side (proxied by retail sales). Industrial production recovers much more quickly than retail sales, lending further support to the conjecture that the demand repercussions of the Covid-19 crisis may be larger and more prolonged than the supply effects.

Figure 2: Industrial production and consumption in China

Source: Netherlands Bureau for Economic Policy Analysis, China's National Bureau of Statistics, and Matthew C. Klein's calculations.

Other research has confirmed the importance of demand effects using different methods. One study finds that the Covid-19 pandemic caused households in Sweden to reduce their spending by almost as much as those in Denmark, despite much stricter lockdowns and greater supply disruptions in Denmark (Andersen et al, 2020). Another finds that demand effects are more important than supply in Germany using a survey of manufacturers (Balleer et al, 2020).

But the dominant role for demand shocks is not a unanimous view, and the evidence varies across countries. Two recent studies find that for most sectors in the United States, the supply effects of the Covid-19 pandemic have been larger than the demand effects (Brinca et al, 2020; del Rio-Chanona et al, 2020).

Whichever effect dominates in a particular country, research consistently finds large roles for both broad types of shock. In fact, the initial shock to supply may have itself caused large falls in demand, in addition to the more direct demand effects of fear and uncertainty (Gourinchas, 2020; Guerrieri et al, 2020).

If one sector of the economy suffers an extreme supply disruption – for example, because lockdowns prevent them from operating – then workers in that sector become unemployed. Without generous unemployment insurance or benefits, those workers experience a fall in income, and so spend less on goods and services from all sectors.

What’s more, firms in the disrupted sector stop buying from other sectors of the economy: hotels don’t need accountants and management consultants if they are shut. In this way, the supply disruption in one sector may spill over into a demand shortage in others. One study finds that these ‘demand chains’ could outweigh the initial supply disruption even if there were no effect of fear and uncertainty on demand (Guerrieri et al, 2020).

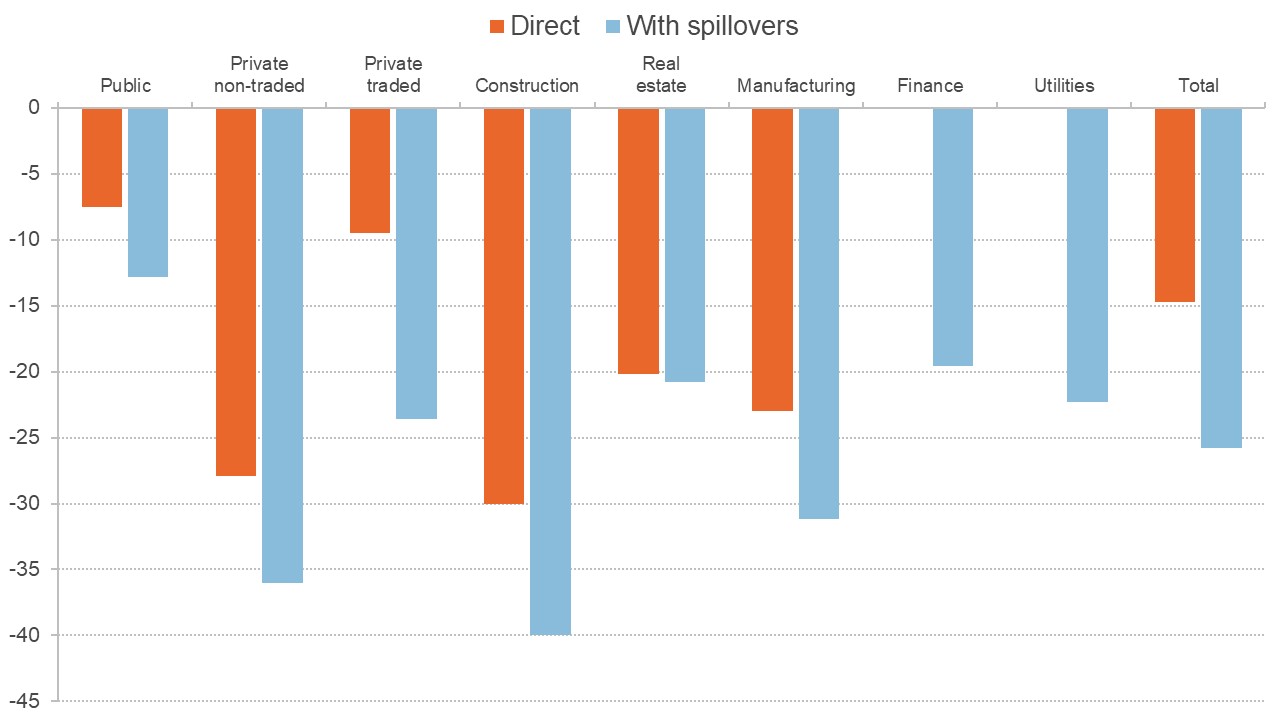

Figure 3: Illustrative effect of stay-at-home measures on sectoral GDP

Source: NIESR Dynamic Sectoral Model, Lenoel and Young (2020).

What does this mean for policy?

The evidence suggesting a prominent role for demand shocks implies that policies aimed at stimulating aggregate demand are very effective tools to support the economy. This is precisely what the mixture of monetary relaxation and government spending expansions deployed around the world in response to the Covid-19 crisis are designed to do, although it should be noted that these policies may have little effect if the demand fall is largely due to people’s fears of contracting the virus and uncertainty about losing their jobs. Since the supply effects are also large, public health policies also benefit the economy by enabling people to return to work safely.

Related question: How much will lifting lockdown start to reverse the UK's economic slump?

The possibility that supply shocks in some sectors spill over as demand shocks to others provides another rationale for policy-makers to try to counter both types of disruption at the same time. The National Institute of Economic and Social Research (NIESR) estimates these spillover effects using a sectoral model, which suggests that once these are taken in account, many sectors suffered similar falls in activity in lockdown (see Lenoel and Young, 2020).

Policies to help people to return to work safely coupled with strict lockdowns for those who can work from home could reduce the disruption to supply, and government spending or monetary policy could stimulate demand. Together these would reduce the supply impact on sectors of the economy where work cannot be done remotely, and help to prevent the disruptions in those sectors from spilling over into others.

Furlough schemes like the CJRS can help on both fronts. On one hand, they reduce income losses from unemployment, and so reduce the potency of the demand chain effect. At the same time, they also reduce the long-term supply disruption of the Covid-19 pandemic by preventing the destruction of productive employer-employee relationships.

Related question: How does the government's furlough scheme work?

Generous unemployment benefits can also play an important role in preventing supply falls in some sectors of the economy causing demand falls across all sectors by supporting the incomes of those made unemployed.

Related question: Why should the government provide income protection in a recession?

How reliable is the evidence?

It is important to bear in mind that the comparison of income and expenditure presented here is very preliminary and only suggestive. There are many potential ways of distinguishing supply and demand effects, and they are likely to vary across sectors as well as across countries. Indeed, some industries, such as health, pharmaceuticals, home delivery, online retail and information and communications technology services, have actually faced an increase in demand (see, for example, Hacioglu et al, 2020, for the UK).

The consistent finding across different research strategies that both supply and demand falls are important in most sectors goes some way to confirming that these results are not dependent on specific research methods, though there is still no consensus on which type of shock matters the most.

Economists often distinguish the two types of shock by their effects on prices, but our ability to classify the shocks in real time is limited as prices usually react slowly to shocks. It is likely that we will need to wait for more data to come in before economists can reach a consensus on whether supply or demand matters more in the Covid-19 recession.

As well as the delayed reaction of prices to shocks, the Covid-19 recession presents an extra challenge in that average prices in the economy are measured across a large basket of goods and services, but many services have been completely shut down and so do not have prices at the moment. Researchers using price data have dealt with this problem by considering prices in individual sectors rather than in the economy overall (Brinca et al, 2020).

Related question: How can we measure consumer price inflation in a lockdown?

Where can I find out more?

Consumption in the time of Covid-19: Evidence from UK transaction data: Sinem Hacioglu, Diego Kaenzig and Paolo Surico present real-time indicators on consumer spending, labour income, mortgage payments and household financing needs. They emphasise the heterogeneous effects of the Covid-19 crisis, both across sectors of the economy and across households, presenting suggestive evidence of a more prominent role for demand factors.

Decomposing demand and supply shocks during Covid-19: Pedro Brinca, Joao Duarte and Miguel Faria e Castro attempt to distinguish between different types of shocks across sectors in the United States using patterns in wages and hours. They find that supply shocks are the most important.

Viral recessions: Lack of demand during the coronavirus crisis: Veronica Guerrieri, Guido Lorenzoni, Ludwig Straub and Iván Werning show how shutting down one sector of an economy can spill over into a demand shortage in other sectors if there is insufficient unemployment insurance.

Social distancing and supply disruptions in a pandemic: Martin Bodenstein, Giancarlo Corsetti and Luca Guerrieri argue that lockdowns targeted to those who can work from home are beneficial in responding to the supply-side aspects of the Covid-19 recession.

Predicting the supply and demand shocks of the Covid-19 pandemic: An industry and occupation perspective: Maria del Rio-Chanona, Penny Mealy, Anton Pichler, François Lafond and Doyne Farmer estimate the supply and demand effects on different sectors in the United States using data on how easily people in those sectors can work remotely.

Tracking the UK economy in real time: Paolo Surico discusses research with Sinem Hacioglu Hoke and Diego Kaenzig, which explores how the income and spending of UK households has been affected by the Covid-19 pandemic using data on transactions in the current, credit and savings accounts of users of a large fintech company.